World News – June 2019

Container throughput continues to grow in Rotterdam. Following a record year in 2018 and a record quarter in 2019, April of this year was the best month ever for the Port of Rotterdam. 13.6 million tonnes of container freight was handled in April 2019. The previous record month was August 2018 (13.2 million tonnes). Measured in TEU, the standard unit for containers, April 2019 was the second-best month ever, with 1.3 million TEU, just a fraction lower than the record month of August 2018.

Rotterdam can accommodate further growth

Rotterdam has expanded to become Europe’s largest container port, partly because of its excellent depth. The Port of Rotterdam Authority is excellently placed to accommodate further expansion in this growth market because:

- there is sufficient available capacity at the deep-sea terminals;

- the port has good hinterland connections via inland shipping, road and rail;

- we are making considerable investments in the physical infrastructure, such as the Container Exchange Route, which enables faster and more cost-efficient exchange of containers between the terminals;

The Port of Rotterdam Authority is leading in the digital infrastructure with logistics solutions such as Pronto, Navigate, Nextlogic, OnTrack, Box Insider and Deliver. No other port has such a complete digital toolbox as Rotterdam.

Digital transformation selling point during TLM 2019

The Port of Rotterdam Authority is participating in the 2019 Transport & Logistics trade fair in Munich from 4 to 7 June. Digital transformation of port and logistics will be an important ‘selling point’ there for the Port of Rotterdam Authority. We want to create a global network of smart connected ports. This will increase efficiency in global trade lanes, lower costs and reduce CO2 emissions.

Special attraction: Container 42

‘Container 42’ is a metaphor for this digital transformation, which is why it is a special attraction this year at Transport & Logistics Munich. ‘Container 42’ is the hyperintelligent container that started its two year data collection journey around the world in Rotterdam on 24 May, with Munich as first stopover. The container, equipped with sensors and communications technology, measures vibration, gradient, position, sound, air pollution, humidity and temperature during the journey. The container is also equipped with solar panels, to see how much energy a container can generate during a journey on a container ship, train or truck.

https://container-news.com/rotterdam-enjoys-container-volume-growth-digitisation/

Construction of the Svea Terminal – a new rail connected crossdocking terminal for forest products at the Port of Gothenburg – is now under way. The new terminal will offer weather-protected transloading immediately beside the port’s ro-ro and container terminals. Operations are due to commence during the first half of 2020.

At the moment, surface preparations are underway at a forthcoming cross docking terminal at the Port of Gothenburg. Export cargo such as paper- and carton board, pulp and sawed timber will be able to travel directly into the terminal for transloading into containers or trailers for onward transport by sea to global markets.

The world’s largest storage tent – 21,600 square metres (equivalent to around three football pitches) – will be built on the 45,000 square metre terminal site, which will allow transloading to take place without being exposed to the elements.

Apart from the tent, there will be open storage areas and five rail tracks. The track leading into the tent will be a production track and the other four tracks will be used as marshalling tracks for the facility.

“Once the new terminal is operational, rail-borne freight volumes at the port could increase even further thanks to the expansion in space and transloading capacity that has been added to keep pace with the market demand. The new marshalling tracks will also reinforce the port’s rail offering as a whole,” said Claes Sundmark, Vice President, Container, Ro-Ro and Rail at Gothenburg Port Authority.

One of many Railport System investments

The Svea Terminal, closely linked to the Railport system, is the latest in a series of rail investments made at the Port of Gothenburg in recent years aimed at increasing capacity and reliability. In 2018, Gothenburg Port Authority completed the Arken Combi Terminal, which has significantly boosted rail capacity at the port. The Swedish Transport Administration is in the process of transforming the Port Line into a double-track system, and APM Terminals has already modernised rail operations and increased the capacity at the Container Terminal.

“Compared with the other larger ports in the world, we have an extremely high proportion of containerised goods that pass through the port by the Railport system. This is largely due to the virtually unbeatable rail concept constantly under development in partnership with the Swedish Transport Administration, freight owners, rail operators, shipping lines and port operators,” said Claes Sundmark.

The Svea Terminal is being built on behalf of the Gothenburg Port Authority with Skanska as the contractor. It is due to open during the first half of 2020.

https://container-news.com/gothenburg-rail-terminal-under-way/

Global container carriers CMA CGM and MSC Mediterranean Shipping Company (MSC) will join TradeLens (www.tradelens.com), a blockchain-enabled digital shipping platform, jointly developed by A.P. Moller – Maersk and IBM.

With CMA CGM, MSC, Maersk, and other carriers committed to the platform, data for nearly half of the world’s ocean container cargo will be available on TradeLens. The addition of CMA CGM and MSC will provide a significant boost to the TradeLens vision of greater trust, transparency, and collaboration across supply chains to help promote global trade. The companies will promote TradeLens and create complementary services on top of the platform for their customers and partners.

“Digitization is a cornerstone of the CMA CGM Group’s strategy to provide an end-to-end offer tailored to our customers’ needs. We believe that TradeLens, with its commitment to open standards and open governance, is a key platform to help usher in this digital transformation,” said Rajesh Krishnamurthy, Executive Vice President, IT & Transformations, CMA CGM Group. “TradeLens’ network is already showing that participants from across the supply chain ecosystem can derive significant value.”

“Digital collaboration is a key to the evolution of the container shipping industry. The TradeLens platform has enormous potential to spur the industry to digitize the supply chain and build collaboration around common standards,” said André Simha, Chief Digital & Information Officer, MSC. “We think that the TradeLens Advisory Board, as well as standards bodies such as the Digital Container Shipping Association, will help accelerate that effort.”

TradeLens enables participants to connect, share information and collaborate across the shipping supply chain ecosystem. Members gain a comprehensive view of their data and can digitally collaborate as cargo moves around the world, helping create a transparent, secured, immutable record of transactions.

According to a statement, the attributes of blockchain technology are ideally suited to large networks of disparate partners. In addition, blockchain establishes a shared, immutable record of all the transactions that take place within a network and enables permissioned parties access to trusted data in real time.

With more than 100 participants on the platform today, TradeLens is already processing over ten million discrete shipping events and thousands of documents each week, providing shippers, carriers, freight forwarders, customs officials, port authorities, inland transportation providers, and others a common view of transactions, which can build trust. A commitment to data ownership rights and permissioned access to data helps ensure privacy and confidentiality while enabling users to collaborate more efficiently with real-time access to shipping data.

“The major advances IBM continues to make in blockchain illustrate that the technology is fostering new business models and playing an important role in how the world works” said Bridget van Kralingen, Senior Vice President, Global Industries, Clients, Platforms & Blockchain, IBM. “More than a hundred participants have put their trust in the TradeLens network and are gaining greater transparency and simplicity in the movement of goods. Together we are advancing a shared aim to modernize the world’s trading ecosystems.”

CMA CGM and MSC to Play an Important Role in the TradeLens Network

CMA CGM and MSC will operate a blockchain node, participate in consensus to validate transactions, host data, and assume the critical role of acting as Trust Anchors, or validators, for the network. CMA CGM and MSC will be on the TradeLens Advisory Board which will include members across the supply chain to advise on standards for neutrality and openness.

Supporting the Entire Shipping Supply Chain

“While carrier participation is critical, it is important to note that the TradeLens platform relies on participation from across the entire supply chain ecosystem,” said Vincent Clerc, Chief Commercial Officer, A.P. Moller – Maersk. “Increasing ease of doing business for our customers and providing visibility across the container journey is at the center of the Maersk strategy. And TradeLens is all about that in its aim to transform the supply chain industry and provide value to all players, from freight forwarders, to ports and terminal operators and inland transportation providers, to customs and other governmental agencies, and ultimately to the customers themselves.”

Beneficial cargo owners like Procter and Gamble will benefit from the addition of more carriers onto the platform. “P&G ships a significant volume of ocean containers every year. Whether filled with our products or the materials used in production, understanding the status of our containers helps us manage an efficient supply chain. We are convinced that the industry will benefit from the transparency and accuracy of blockchain solutions and we are pleased to see MSC, CMA CGM, and Maersk all on the TradeLens platform. We have been testing TradeLens for the P&G business and see potential as the solution scales. We look forward to industry-wide adoption to benefit all network members,” said Michelle Eggers, Director Global Logistics Purchases, P&G.

https://container-news.com/msc-cma-cgm-maersk-tradelens/

With a growing spot capacity and evolving gas trading stock exchange, Turkey is the largest gas market in its region and quickly becoming hot for the competition from major pipeline and LNG producers

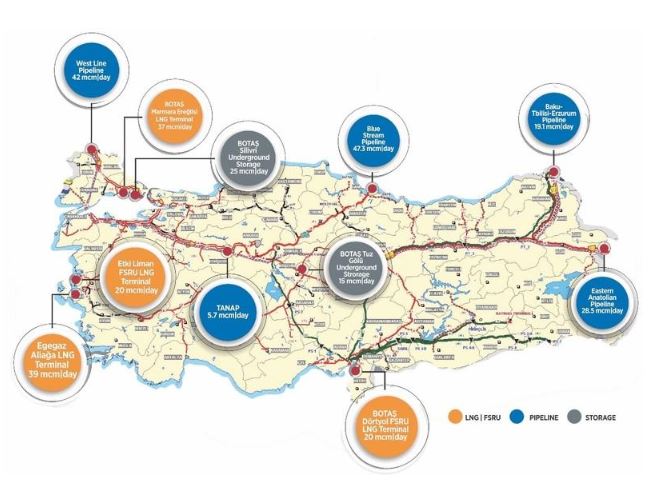

In the last 25 years, Turkey has carried out and participated in various multibillion-dollar energy projects with the goal of diversifying its suppliers and reinforcing its energy infrastructure with regasification facilities. As the country’s infrastructure developed, boosting the storage capacity, it has begun to capitalize on the advantage of multiple suppliers, be it pipeline producers or liquefied natural gas (LNG) exporters. A significant gas importer with 50 billion cubic meters per year, Turkey therefore has evolved into an attractive gas market for big producers, including the U.S., Russia and Qatar. In an environment where the global gas market is witnessing a glut from the biggest producers, Turkey is aspiring to benefit from this buyers’ market where price arbitrage between different markets promises new opportunities for importers.

In almost all of the recent discussions on Turkey’s energy security and policies, experts cannot help but highlight the fact that the country’s gas market is allowing more competition among main exporters since the infrastructure developments, including a vast network of pipelines and significant LNG facilities, grant Turkey the benefit of choice. A recent meeting jointly organized by the Atlantic Council Turkey, Turkish Policy Quarterly (TPQ) and the Turkish Industry and Business Association (TÜSİAD) last Thursday elaborated on the Turkish energy market, witnessing the Turkey launch of the TPQ issue on „Turkey’s Energy Nexus: Discoveries and Development.”

While a significant part of the discussions commended Turkey’s diversification and liberalization efforts with the Trans-Anatolian Natural Gas Pipeline (TANAP) – the biggest part of the Southern Gas Corridor (SGC) – and TurkStream pipeline with Russia in addition to storage and regasification facilities, floating storage and regasification units (FSRUs), its capacity to create a competitive market as an importer was also emphasized.

Turkey’s former ambassador to the Organization for Economic Co-operation and Development (OECD), Mithat Rende, in his expansive elaboration on the Turkish energy developments, remarked, „It is important for Turkey to expand its storage capacity and to have more LNG because it will improve competitiveness.” Considering the recent rise in Turkey’s LNG imports from the U.S., Rende emphatically stated that Turkey will have more LNG coming from the North American country, which has been enjoying an output spike thanks to the unconventional shale gas.

Rende’s statement came as a striking response to the claim of Erica Olson, economic counselor at the U.S. Embassy to Turkey, that when U.S. LNG imports are concerned, market forces and geopolitical forces are coming together. „Pricing will still be very relevant especially for a country like Turkey when Asian markets remain at a higher level,” Olson said.

Recently, though, price dynamics have begun to change as Asian prices slumped last week, and the price spreads between Europe and Asia shrank to below 50 cents from over $1 earlier in May, reducing opportunities for spot trade between the Pacific and Atlantic basins.

At the end of April, an energy consultancy company Stratas Advisors reported that „for the first time in more than three years, the Northeast Asian spot price has dipped below the Dutch TTF marker, presenting a new dynamic.”

With changing price dynamics and the increasing availability of more affordable LNG in global markets, the competition between the dominant producers has grown more fierce. The price competition between the U.S. and Russia had already begun when the latter’s energy giant Gazprom responded to the opening of the Lithuania regasification terminal by discounting its gas price by 23% in 2015. Although Gazprom is still the dominant gas supplier for the European market, U.S. LNG exports to the continent surged 272% in the period of July 2018 and March 2019, the European Commission said in a press release in early May. While the U.S. became the third-largest supplier of LNG to the continent, Europe has emerged as the primary destination of the U.S. LNG in the first quarter of this year.

A significant detail to emphasize is the fact that Turkey became the top importer of U.S. LNG in Europe in the first quarter and ranked the eighth-largest destination for the cargo carrying the American LNG in the said period, according to the data of the U.S. Department of Energy Office of Fossil Energy.

U.S. Embassy Economic Counselor Olson later in her discussion emphasized that Turkey is already the number one importer of the U.S. LNG in Europe and acknowledged, „We continue to look for ways on how we can do more to increase cooperation between the U.S. and Turkey on LNG.”

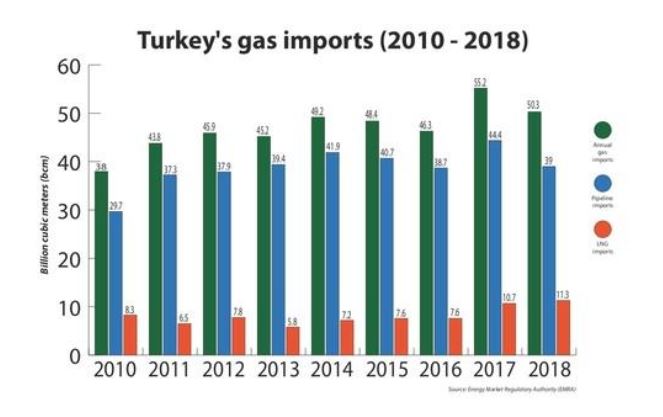

Trends in gas imports

Data from the Energy Regulatory Market Authority (EMRA) demonstrated Turkey’s increasing LNG imports accounted for 22.5% of the total 50.3 billion cubic meters of gas. The country purchased around 11.32 billion cubic meters of gas in the form of LNG last year, the data showed. Furthermore, the figure meant that its dependency on oil-indexed pipeline gas, which is purchased on a long-term take-or-pay basis, fell to 77.5% in 2018 from the previous level of 88% in 2017. Last year, LNG imports reached 11.3 billion cubic meters, while total gas imports were recorded at 50.3 billion cubic meters, 8.8% down from 55.25 billion cubic meters in 2017, the data obtained from the energy watchdog showed.

As far as LNG imports are concerned, Turkey’s two main suppliers are Algeria and Nigeria, which have long-term contracts with the state-ownedPetroleum Pipeline Corporation (BOTAŞ). The gas purchases from the spot market have demonstrated a more fluctuating course over the last decade, reaching the highest level in 2017 with 4.8 billion cubic meters. While Qatar ranked first in spot purchases with 1.5 billion cubic meters, the U.S. ranked third, having exported 767.5 million cubic meters of gas to Turkey.

Turkey recorded the first LNG import from the U.S. in January 2016 with 83.04 million cubic meters of gas, making up the 1.54% of the total 5.4 billion cubic meters of gas imports in that period, the EMRA data said. Aggregate LNG imports from the U.S. in 2016 were calculated at 242.9 million cubic meters and spiked to 767.6 million cubic meters in 2017. In line with the decline in the gas imports, LNG purchases from the U.S. fell to 414.2 million cubic meters, the compiled data from the EMRA demonstrated.

In the first month of this year, Turkey’s gas purchases from the U.S. saw a sudden spike reaching 460.18 million cubic meters, accounting for nearly 8% of the total imports, the data of the energy watchdog showed. LNG imports in January decreased by 6.5% to 5.8 billion cubic meters. In February, the U.S. exported 168 million cubic meters of LNG to Turkey and made up of nearly 4% of the total gas purchases in the month. Turkey purchased 1.7 billion cubic meters of LNG from its suppliers in the second month of the year.

As Turkey expands the share of LNG in its gas portfolio, the imports of pipeline gas – tough still very dominant – have been gradually decreasing. Turkey has started to see declines in the gas imports from Russia, the main pipeline supplier with a market share of over 50% on average. While Russia sold approximately 23.6 billion cubic meters of gas to Turkey last year, its share in the total gas imports declined to 47%, according to calculations from the EMRA data. The decline certainly was not irrelevant to the falling gas imports last year.

In January, Turkey’s gas imports from Russia were down 35% compared to the same period of last year, falling to 1.8 billion cubic meters. Russia’s share in monthly gas purchases from abroad was 31.6%. While monthly gas imports in February were down 20% compared to the same period of last year, Russia’s gas exports to Turkey declined by 51.8% to 1.2 billion cubic meters. The country’s share in the monthly gas imports in February was 28.4% as purchases from the spot LNG market increased.

The installation of two floating storage regasification units (FSRU), one in İzmir’s Aliağa district and the other in Hatay’s Dörtyol district, as well as the capacity expansion of the existing terminals allowed Turkey to have more LNG in its system. As a result, the LNG facilities are capable of regasifying 117 million cubic meters of gas per day. The reinforcement of the infrastructure has enabled Turkey to multiply its gas suppliers in addition to those who sell gas to the country on long-term take-or-pay contracts with strict destination clauses.

Ambitions for a gas trading hub

Some of Turkey’s long-term gas contracts will expire in 2021, and the number of gas imports stipulated in those contracts total 15.6 billion cubic meters, corresponding to nearly 30% of the annual gas consumption. As the country is negotiating the renewal of these gas contracts, it looks for more the removal of some strictly binding terms. The private sector importers also expect that BOTAŞ may transfer some of its import licenses as the market needs for the liberalization moves in order to support the ambition to reinforce the gas trading hub launched by the Energy Stock Exchange (EPİAŞ) in September 2018 with a view to ensuring a daily price mechanism.

Although some scholars and experts claim that Turkey does not „need” to be a gas hub since it is already an important „transit” route with mega pipelines like TANAP and TurkStream. Because, they maintain, becoming a gas hub does not necessarily bring financial power. However, Melanie Kenderdine, a nonresident fellow at the Atlantic Council’s Global Energy Center, emphasized the benefits of a competitive Turkish pricing point in her article entitled „The Importance of Natural Gas to Turkey’s Energy and Economic Future,” published in the TPQ issue on Turkey’s Energy Nexus.

Speaking of the advantages of „a competitive Turkish pricing point and liquid supply source,” Kenderdine emphasized that it could certainly contribute to the national economy and enhance energy security while giving Turkey „a larger stake in improving regional stability, increasing production and promoting low cost infrastructures.”

While Turkey has achieved a great deal on the infrastructure side, progress toward a Turkish natural gas trading hub requires some regulatory and market changes. In addition to the continued implementation of market reforms, the unbundling of long-term contracts held by BOTAŞ is also another factor to move toward a gas hub, she argued.

Since Turkey’s pipeline imports are priced on oil, the rolling average of pipeline contracts also increased last year. A market setting comprised of rising oil prices and the depreciating Turkish lira also put an extra burden on the cost of subsidies. „The creation of a natural gas hub would effectively de-link natural gas prices from oil prices, removing a significant source of gas price volatility that has little to do with the fundamentals of natural gas market,” Kenderdine wrote.

Turkey’s position as an important gas route to Europe has been established and will become more prominent with the launch of TANAP. In this context, a natural gas hub, Kenderdine suggested, would also allow Turkey to respond to demand from connected European purchasers and to add to the overall global supply

https://www.dailysabah.com/energy/2019/05/29/turkey-becomes-an-increasingly-competitive-market-for-us-russian-gas